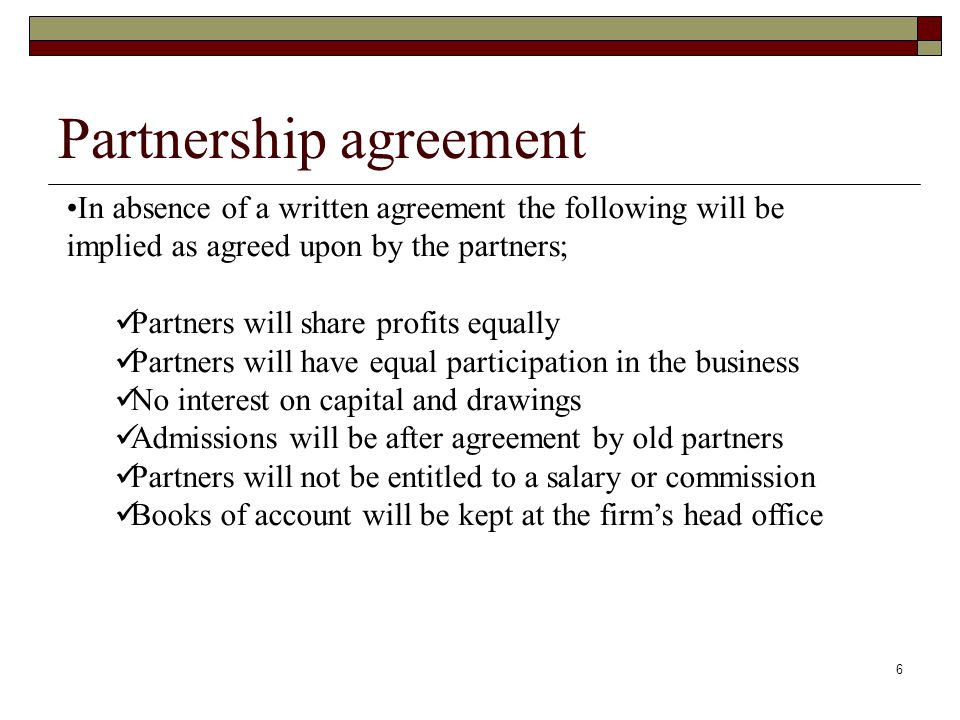

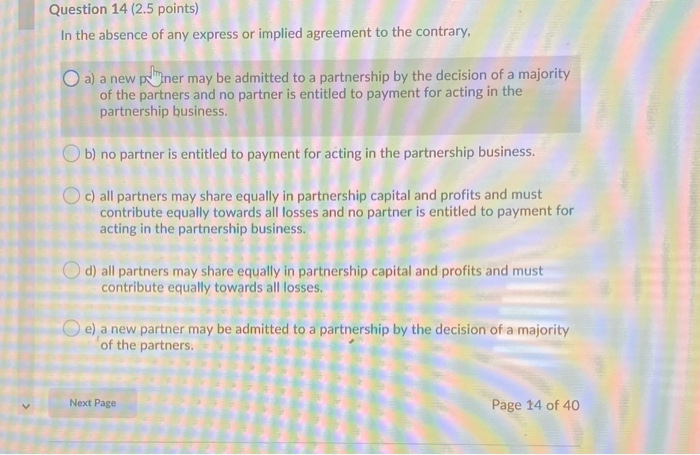

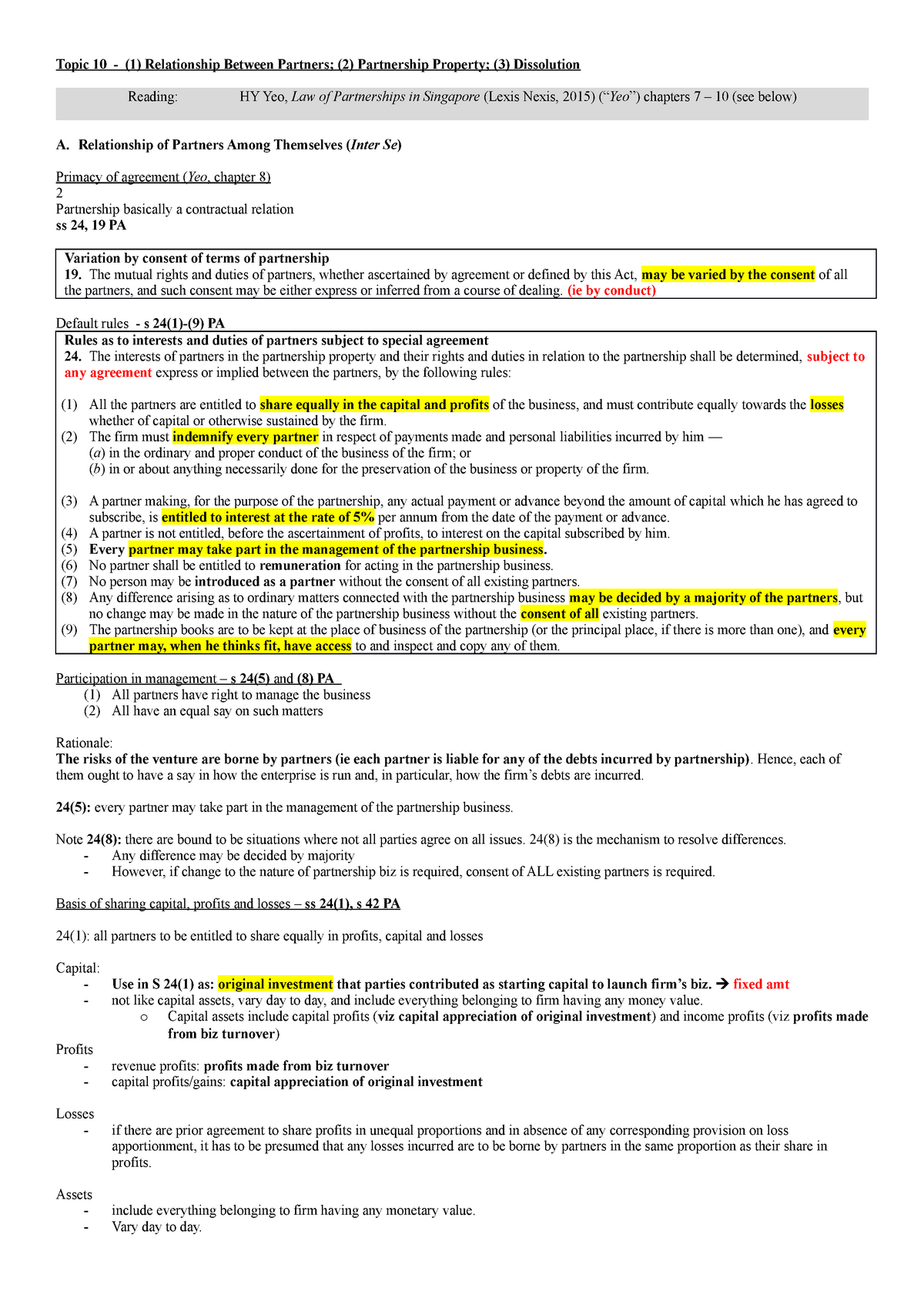

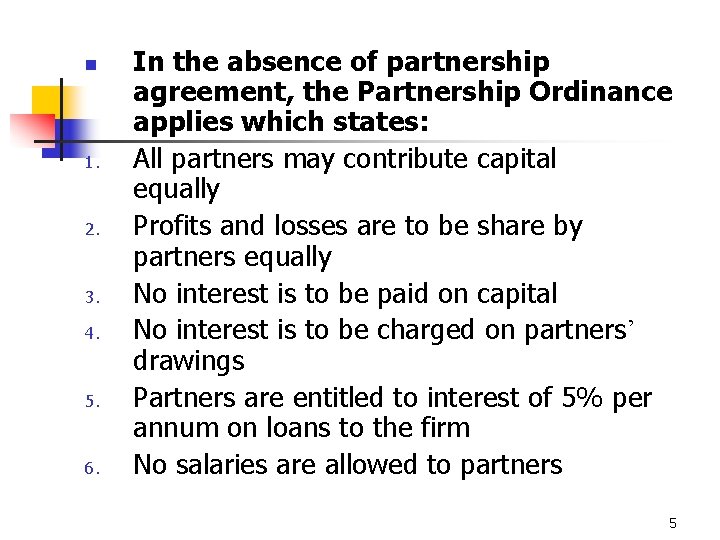

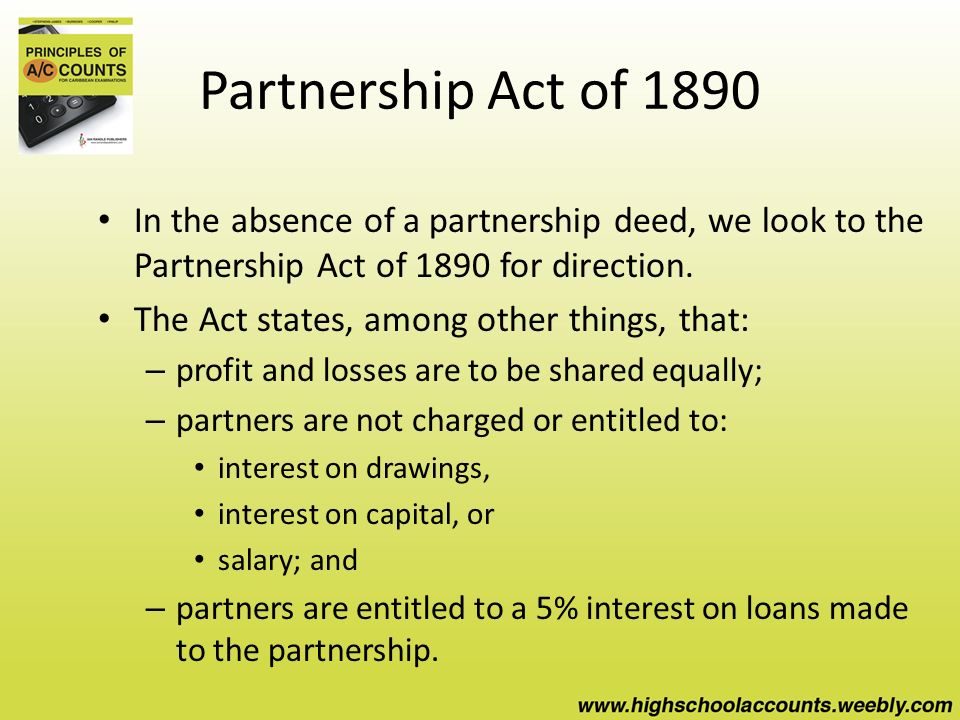

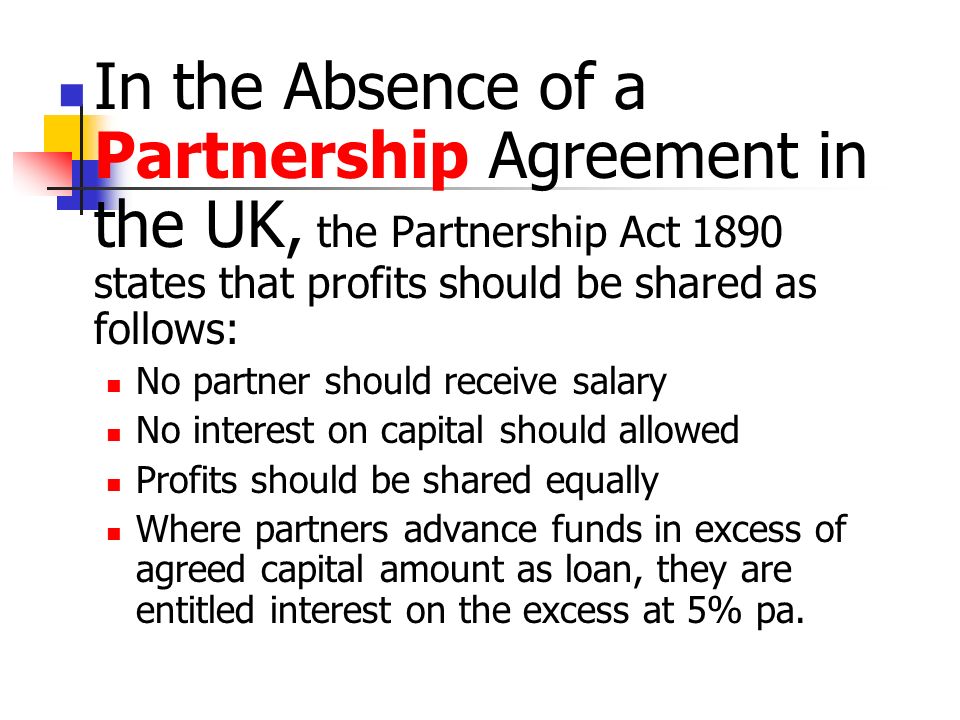

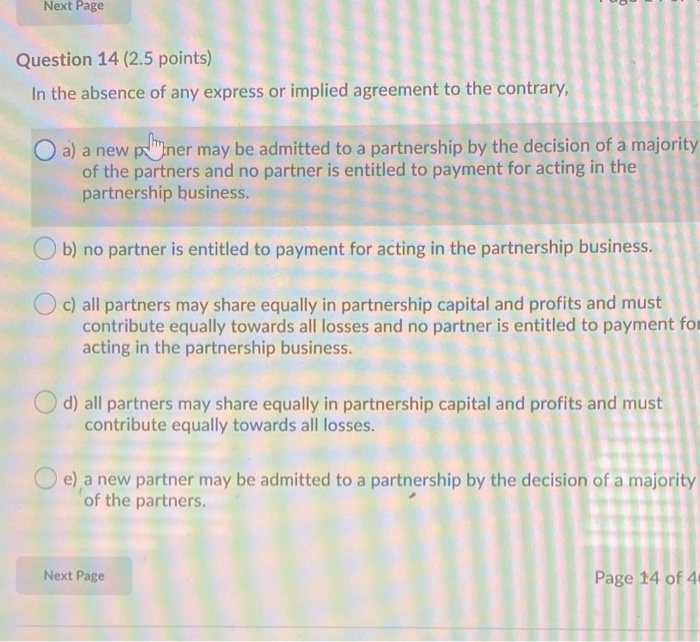

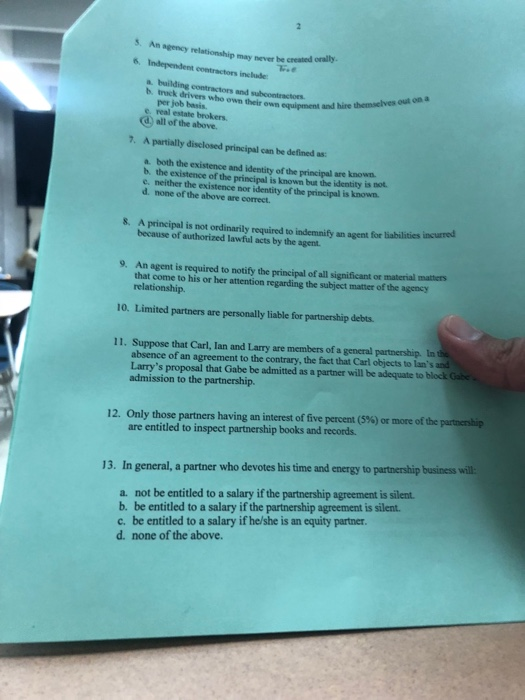

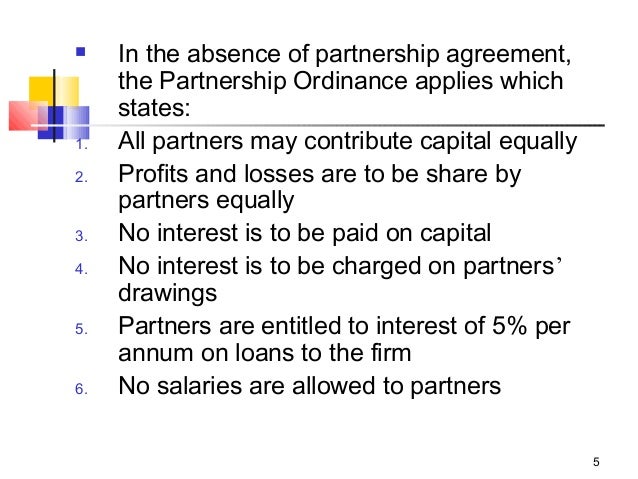

In absence of Partnership agreement interest on partner's loan/Advance will be calculated at 6% pa (5% / 6% / 8%) 14 The partner who does not participate actively in partnership business is knows as nominal (nominal / inactive) partner when partnership deed is absent Study Test Time RULES APPLICABLE IN THE ABSENCE OF PARTNERSHIP DEED As we know from the previous discusion that it is not cumpulsory to have a partnership deed for a partnership firm Hence if a firm is not having any written agreement or a partnership deed or if partnership deed is there but it is silent on In the absence of agreement, partners are not entitled to Salary Commission Equal share in profit Both (a) and (b) 12 In the absence of partnership deed, partners share profits or losses In the ratio of their Capitals In the ratio decided by the court Equally In the ratio of time devoted

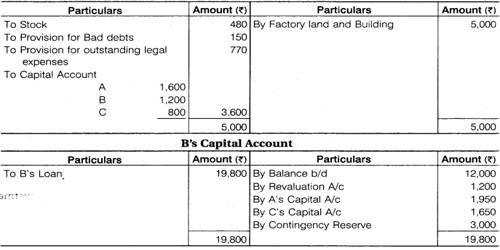

Partners Loan Account With Interest Thereon Assignment Point

In absence of partnership deed partners are entitled to

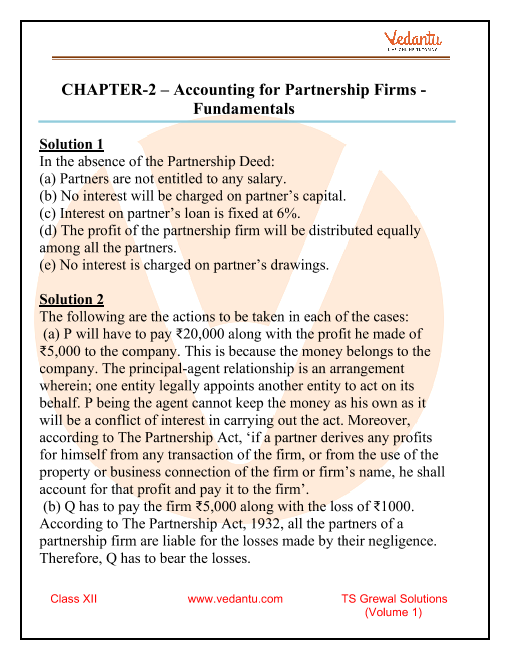

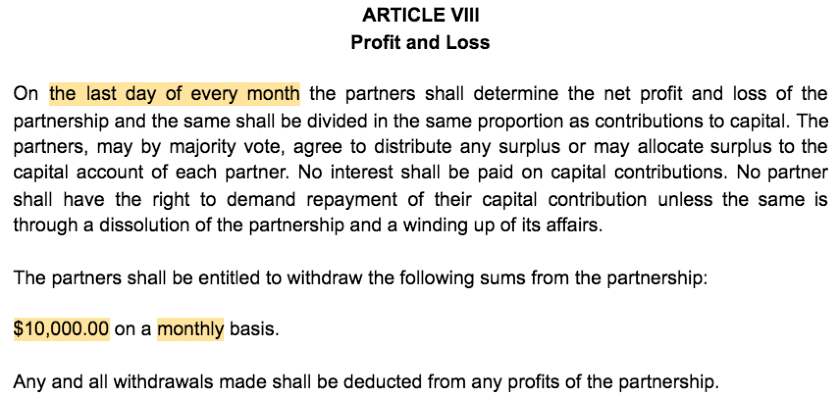

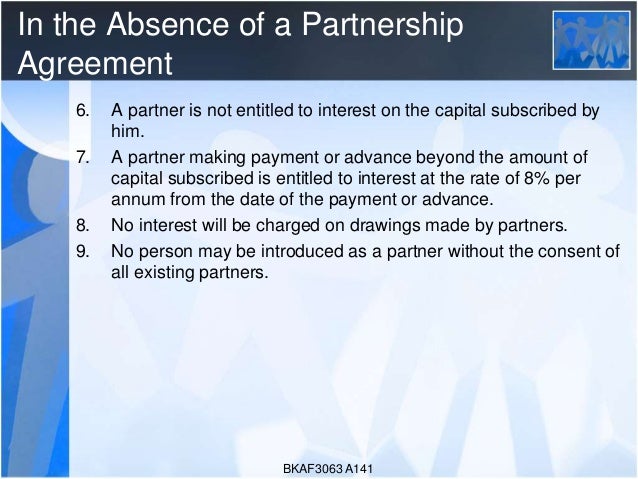

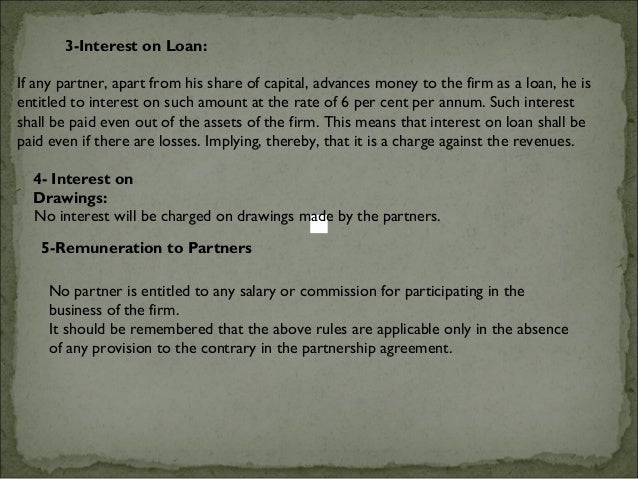

In absence of partnership deed partners are entitled to-But, in the absence of agreement, the following provisions of the Indian Partnership Act, 1932 shall apply for accounting purposes 1 Interest on Capital No interest is allowed on Capitals of the Partners If as per the partnership deed, interest is allowed, it will be paid only when there is profit If loss, no interest will be paid 2 Interest on Drawings No interest will be charged on drawingsIn the absence of partnership deed, what are the rules relating to (a) Interest on partners capital

Week 12 Lobo Prof Stephen Bull Law Of Business Organisations Smu Studocu

(iv) Interest on Partners Loan In the absence of partnership deed if partner gives any loan to the firm he/she will be entitled to get a fixed percentage of interest @6% of annum (v) Salary of Partner In the absence of the partnership deed a partner will be entitled for getting any salary for his work even if the others are non working In the absence of partnership deed, profit will be distributed equally between all partners Answer Answer True In the absence of an agreement, partners are entitled to (a) Salary (b) Profit share in capital ratio (c) Interest on loan and advances (d) Commission Answer Answer (c) Interest on loan and advances

In the absence of any deed of partnership Only working partners are entitled to Salary Partners are entitled for commission @ 6% of the net profits of the firm Partners contributing highest capital is entitled for interest on capital @ 6% paIn the absence of partnership deed, interest on capital will be given to the partners at (b) 6% pa (d) None of these (b) Real Account (d) None of these In the absence of partnership deed, partners are not entitled to receive (a) Salaries (b) Commission (c) Interest on Capital (d) All of these Answer Answer (d) All of theseIn the absence of partnership deed partners are entitled to >> Class 12 >> Accountancy >> Accounting for Partnership Basic Concepts >> Nature of Partnership

In the Absence of Partnership Deed, Specify the Rules Relating to the Following (I) Sharing of Profits and Losses Accountancy (i) Sharing of profits and losses (ii) Interest on partner's capital (iii) Interest on Partner's drawings (v) Salary to a partner Partners are not entitled to receive in the absence of partnership agreement (a) salaries (b) interest on capital (c) fees and commission (d) All of the above general introduction of partnership;In the absence of partnership deed, a partner is entitled to an interest on the amount of additional capital advanced by him to the firm at a rate of (A) entitled for 6% pa on their additional capital, only when there are profits (B) entitled for 10% pa on their additional capital entitled for 12% pa on their additional capital

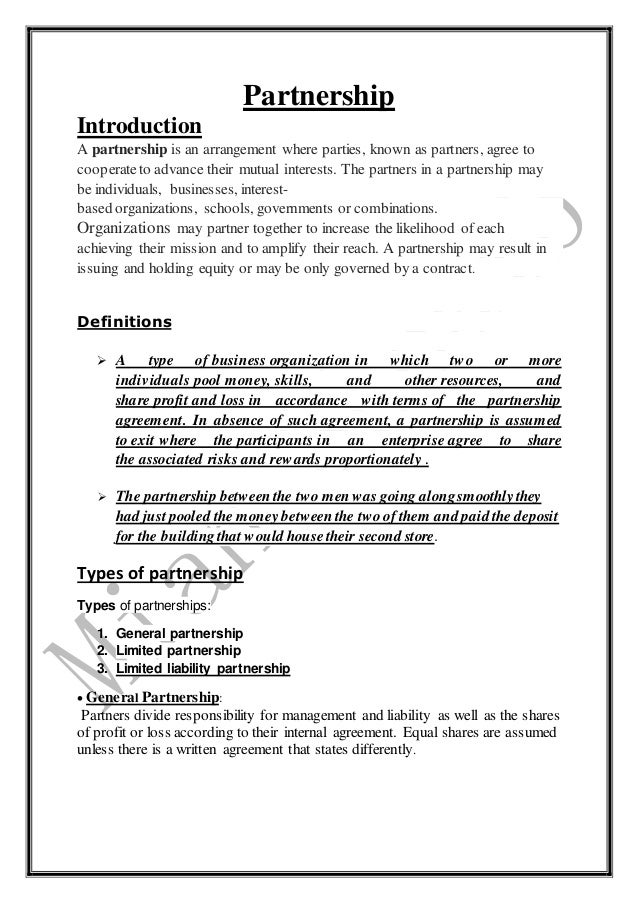

Rights Of Partners Who Withdraw And Leave A New Jersey Partnership

Partnership Deed Q 1 Q 6 Ch 2 Ts Grewal S 21 Class 12th

In case of partnership deed is silent then section 2 of the Partnership Act 1932 will apply according to the Section partners are not provided with remuneration it is clearly mentioned that unless there is an agreement between the partners to the contradiction of section the partners are not eligible to have a remuneration for their contribution towards the firm moreover they cannot 4 In the absence of partnership deed, the partner will be allowed interest on the amount advanced to the firm by him at the rate of (A) 6% (B) 6% pa 12% (D) None of these Answer 6% pa 5 In partnership firm, profits and losses are shared—(A) Equally (B) In the ratio of capitals As per Agreement (D) None of these Answer As per Agreement 6 23 In the absence of partnership deed, the following rule will apply (A) No interest on capital (B) Profit sharing in capital ratio Profit based salary to working partner (D) 9% pa interest on drawings Answer Answer A

Partnership Internal Relations Question In The Absence Of A Written Partnership Agreement How Studocu

Department Of Accounting And Finance Course Code Acc Ppt Download

2jnomj8w4bzlom

What Is A Partnership Agreement Insights Alston Asquith

Nature Of Partnership And Partnership Deed Concepts With Examples

Leaving A Partnership Without An Agreement Kppb Law

Free Partnership Agreement Create Download And Print Lawdepot Us

Dissolving A Business Partnership Without An Agreement Miller Law

In The Absence Of Any Provision In A Partnership Deed At What Rate Is A Working Partner Entitled For Remuneration Quora

Partnership Agreement Form Georgia Free Download

Partnership

Institute Of Commerce Gurgaon Home Facebook

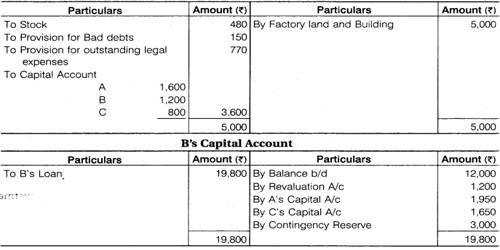

16 Pavan Prince And Roy Were Partners In A Firm Sharing Profits In 2 2 1

1 Topic Nine Partnership 2 A Business Carried Out By People In Agreement To Share Profits And Losses Each Partner Is A Partner Of The Others Business Ppt Download

Partnership At Will Pdf Partnership Law Of Agency

In The Absence Of An Agreement Partners Are Entitled To

James Company A Proprietorship Had The Following Chegg Com

Rights And Responsibilities Of Partners In A Partnership Firm Legalwiz In

Ts Grewal Solutions Class 12 Accountancy Volume 1 Chapter 2 Accounting For Partnership Firms Fundamentals

Rules Applicable In The Absence Of Partnership Deed Youtube

Week 12 Lobo Prof Stephen Bull Law Of Business Organisations Smu Studocu

Introduction Of Partnership Accounts 1 Characteristics Of Partnership

Leaving A Partnership Without An Agreement Kppb Law

State The Provisions Of Partnership Act 1932 In Absence Of Partnership Deed Regarding 1 Interest On Partners Drawings And 2 Interest On Accountancy Accounting For Partnership Basic Concepts Meritnation Com

Cbse Class 12 Rules Applicable In Absence Partnership Deed With Illustration In Hindi Offered By Unacademy

Partnership Agreement What It Is Nerdwallet

Igcse At Ua

Study Materialworkshop 16 Pdf Debits And Credits Goodwill Accounting

Partnership Accounting Ppt Video Online Download

Partners Loan Account With Interest Thereon Assignment Point

Rights Of Partner As Per The Indian Partnership Act 1932

1

Extwprlegs1 Fao Org

Business Entity Selection Series 3 General Partnership Texas Agriculture Law

Fundamentals Of Partnership Mcqs And Answer 12 Cbse Exam 22

Partnership Definition Features Advantages Limitations

Updates On The Indian Partnership Act 1932 Amp E Compliance

Clauses Partnership Agreement Pdf Partnership Leasehold Estate

Papers Ssrn Com

Accounting For Partnerships Ppt Video Online Download

1

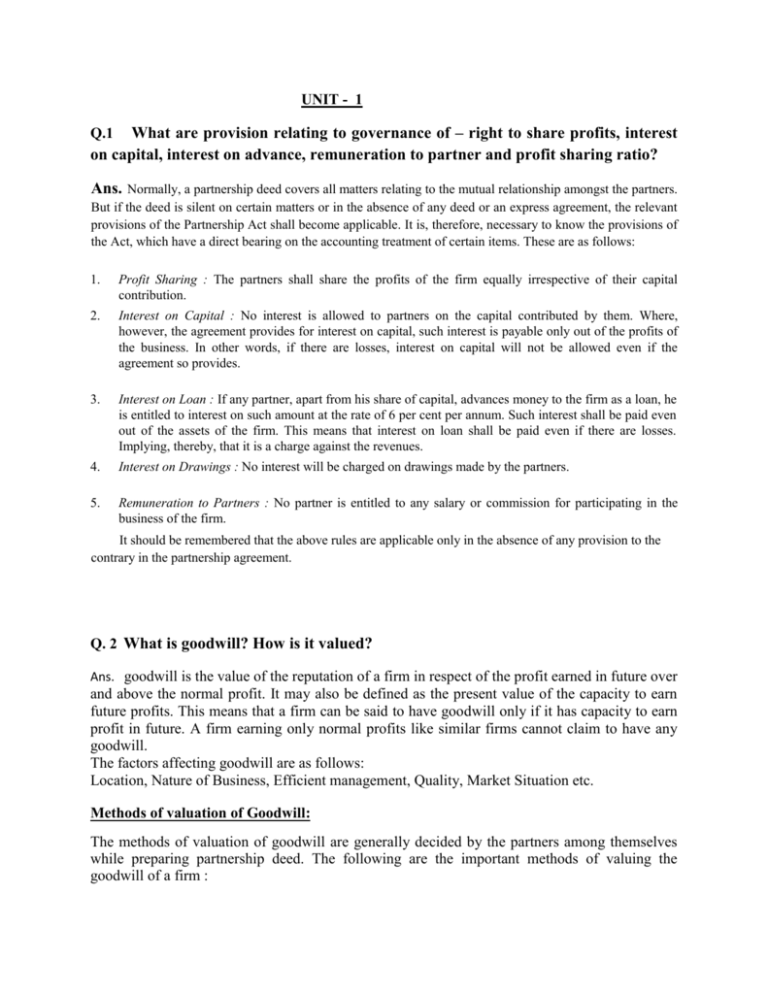

Q 1 What Are Provision Relating To Governance Of Right To Share

Ts Grewal Solution Class 12 Chapter 5 By Studies Today Issuu

Day 5 Class 12th Commerce Rules Applicable In The Absence Of Partnership Deed Youtube

Partnership Deed Its Importance And Rights Of Partners Accounting Finance

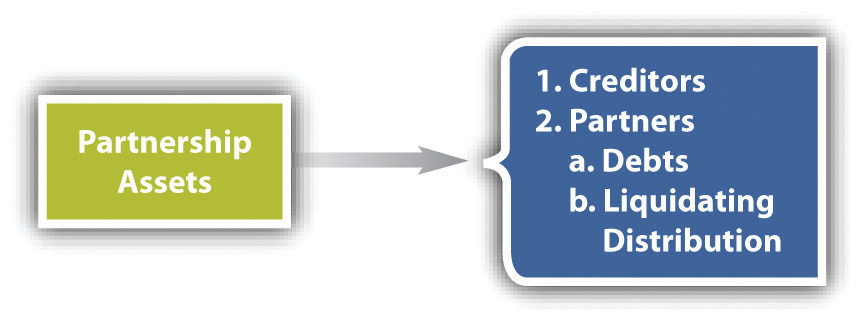

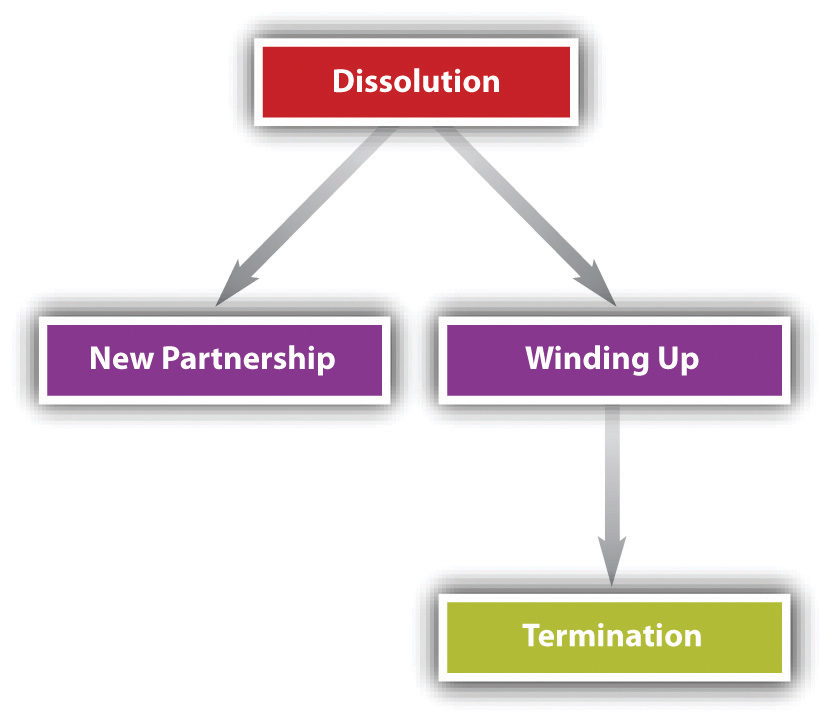

Dissolution And Winding Up

How To Create A Business Partnership Agreement Free Template

Solved Next Page Question 14 2 5 Points In The Absence Of Chegg Com

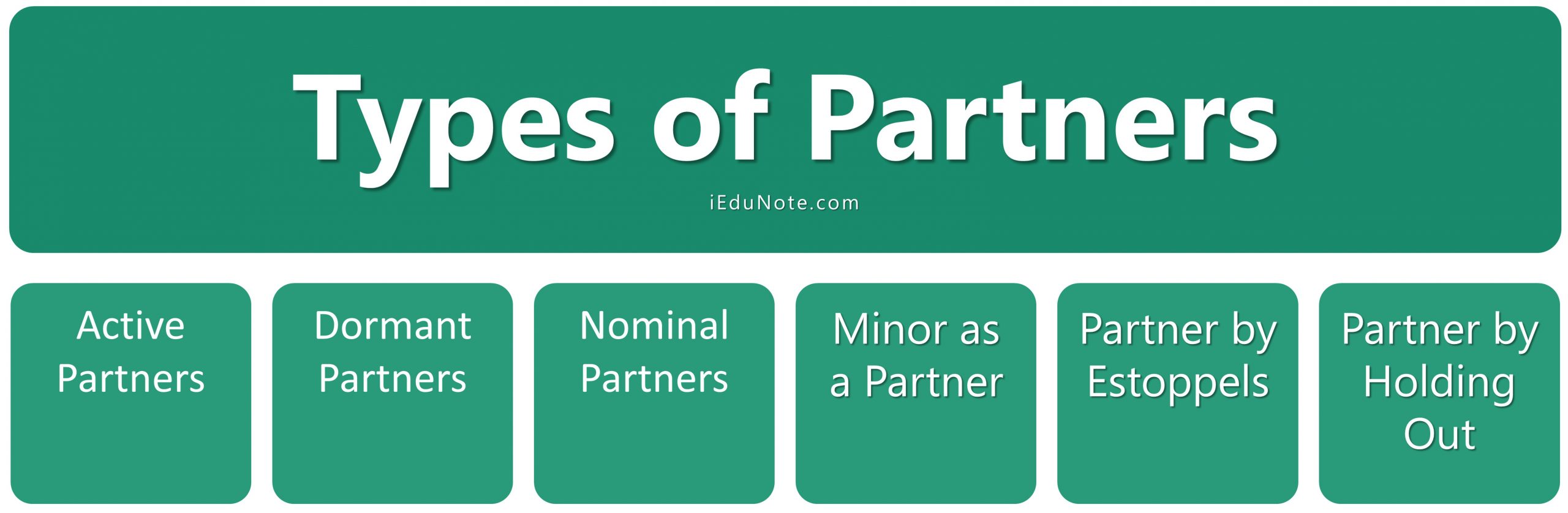

Types Of Partners In Partnership Business Rights Duties Liabilities Of Partners

Law Partnership Partner 7

Cbse Class 12 Rules Applicable In Absence Partnership Deed With Illustration In Hindi Offered By Unacademy

An Agency Relationship May Never Be Created Craly Chegg Com

Class 12 Accountancy Chapter 5 Notes Youtube

Skofirm Com

Cbse Class 12 Rules Applicable In Absence Of Agreement In Hindi Offered By Unacademy

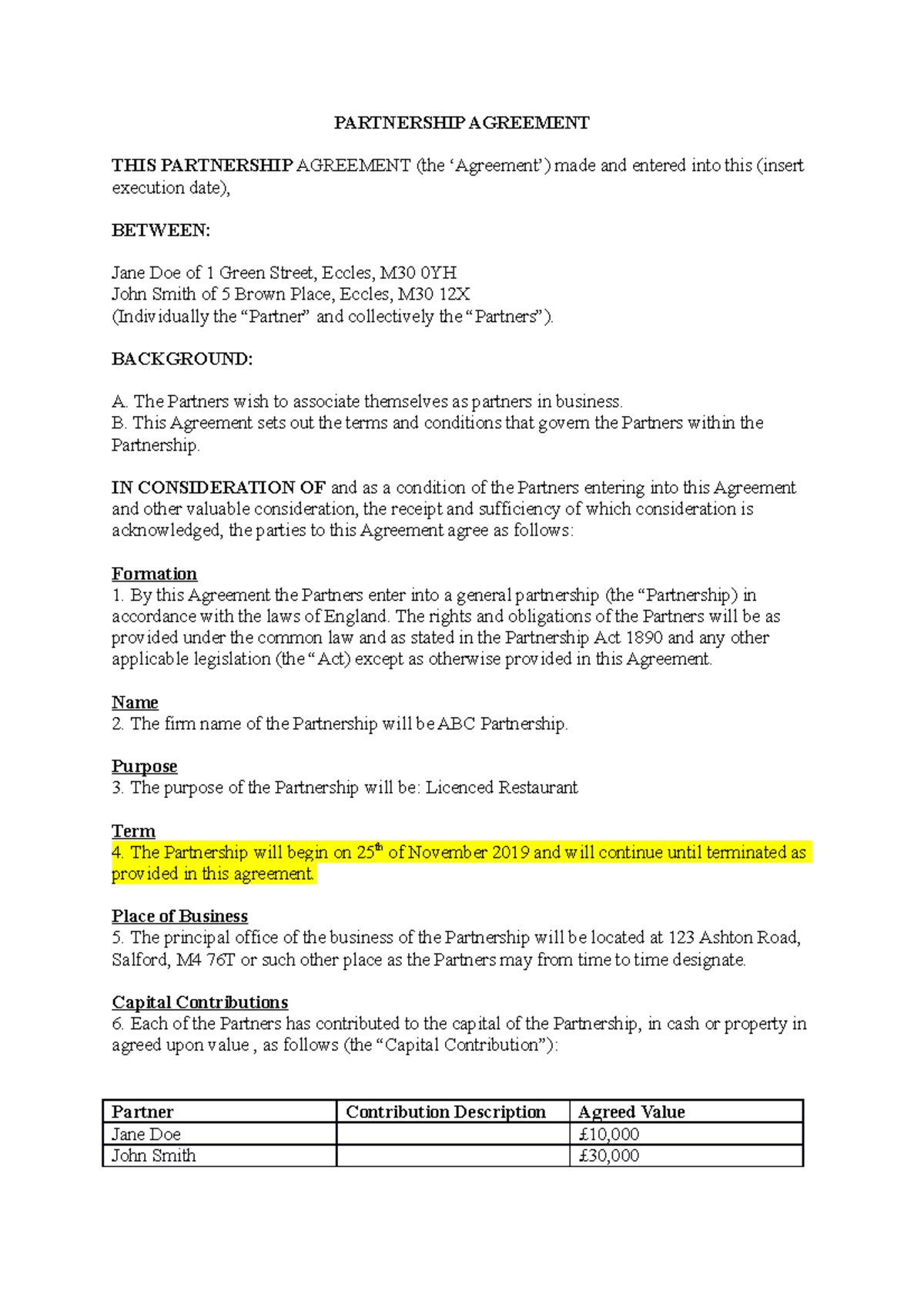

Partnership Agreement Example Partnership Agreement This Partnership Agreement The Agreement Studocu

Partnership Rules Faqs Findlaw

Free Partnership Agreement Create Download And Print Lawdepot Us

In Partnership Why Is Interest Charged On Drawings

Partnership Definition Features Advantages Limitations

Tax Rules For Partnership Interest Changes Bader Martin

Stlawrencehighschool Edu In

Partnership Accounting

Free Partnership Agreement Create Download And Print Lawdepot Us

My Word Is My Bond But Will It Hold Without A Written Agreement Harrison Clark Rickerbys

Moving Beyond Rhetoric The Eu Japan Strategic Partnership Agreement

Class 12 Accounts Fundamental Of Accounts Notes

2 Mahesh Ramesh And Suresh Are Partners In A Firm They Do Not Have A Partnership Deed At The End Brainly In

General Partnership How It Works Pros Cons Nerdwallet

Legal Structure 10 Elements Of A Partnership Agreement

Partnership Accounting

In The Absence Of Any Agreement The Partners Are Entitled To Share Profits

Americanbar Org

Dissolution And Winding Up

Class 12 Accounts Fundamental Of Accounts Notes

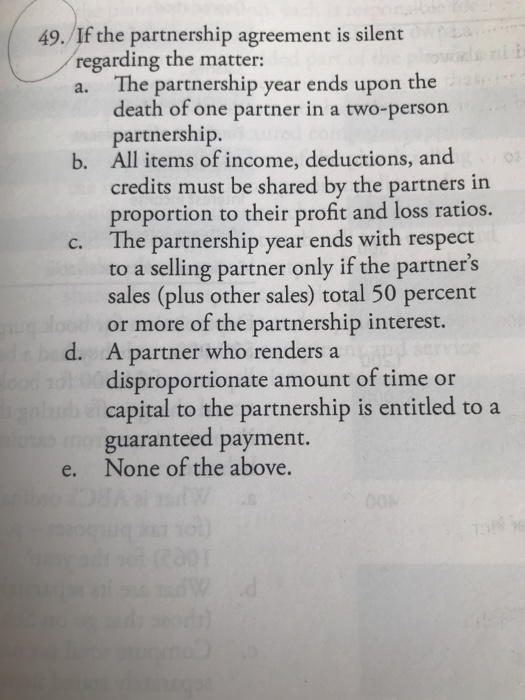

Solved P 49 If The Partnership Agreement Is Silent Chegg Com

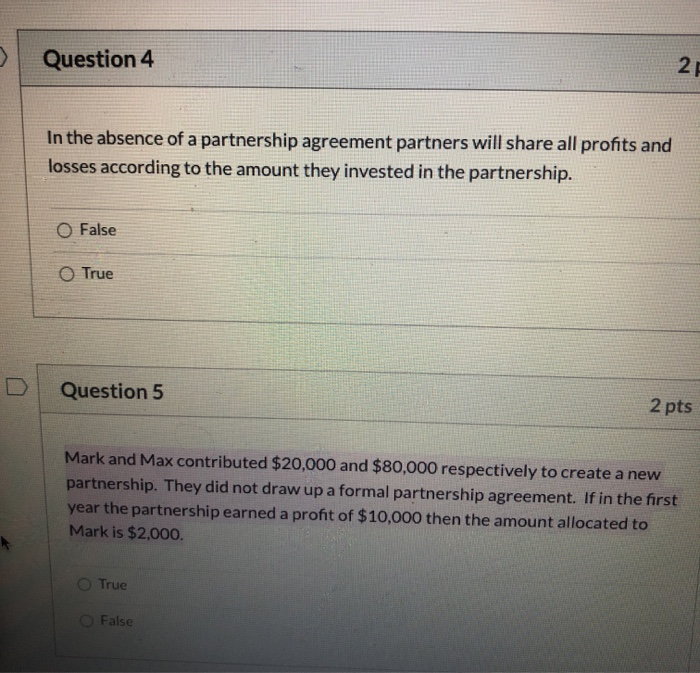

Solved Question 4 2 In The Absence Of A Partnership Chegg Com

All You Need To Know About The Indian Partnership Act 1932

Imo Ie

Accountancy Higher Secondary Second Year Volume Ii Untouchability Is A Sin Untouchability Is A Crime Untouchability Is Inhuman Pdf Free Download

Class 12 Accounts Fundamental Of Accounts Notes

General Partnerships Explained The Business Professor Llc

Assignment Of Partnership Interest Legal Templates

Notes Partnership Pdf Partnership Interest

Page 30 Debk Vol 1

How To Create A Business Partnership Agreement Free Template

Partnership Fundamentals Objective Type Mission Accountancy

Partnership Agreement State Bar Of Georgia

Repository Law Umich Edu

Ts Grewal Accountancy Class 12 Solutions Chapter 1 Accounting For Partnership Firms Zoefact

Reconstitution Of Partnership Deed

General Partnerships Explained The Business Professor Llc

In The Absence Of Specific Provision In The Partnership Deed At What Rate Interest On Drawing Of The Partners Would Be Allowed

Deed Of Partnership

Lergp Com

No Partnership Deed Exist Absence Of Partnership Deed Partners A And B Have Contacted You To Solve Brainly In

/GettyImages-1152013583-a5bad8090c064339bf7880b7c9012379.jpg)

Which Terms Should Be Included In A Partnership Agreement

Limited Partners What Are Your Rights Mercer Capital

Partnership Agreement What It Is Nerdwallet

Dissolving A Business Partnership Without An Agreement Miller Law

0 件のコメント:

コメントを投稿